Ao lado de Donald Trump, Barack Obama aparece e será provavelmente lembrado como um político deveras preocupado com a questão ecológica. Nenhum presidente anterior ostentou, de fato, um discurso tão pontuado por alertas sobre as mudanças climáticas.

Na realidade, o legado de sua administração em termos de diminuição nas emissões de GEE é negativo. Em parte porque suas iniciativas foram bloqueadas pelo Congresso e pela Suprema Corte, como é em especial o caso do Clean Power Plan. Em parte também porque Obama implementou políticas em nada desfavoráveis ao modelo energético fóssil que sua brilhante oratória apregoava combater.

Prova irrefutável disso são as mensurações das emissões de GEE dos EUA ao longo de seus dois mandatos (2009 – 2016). Segundo dados da EPA, em 2009, os EUA emitiram 6,82 gigatoneladas de GEE (sobretudo dióxido de carbono, metano e óxido nitroso). Em 2014, esse número subiu para 6,87 gigatoneladas de GEE. Um aumento de 50 milhões de toneladas de GEE. Veja-se:

(https://www3.epa.gov/climatechange/Downloads/ghgemissions/US-GHG-Inventory-2016-Main-Text.pdf)

Além disso, sua reação ao desastre do Golfo do México em 2010 foi de quase total permissividade. A moratória decretada por Obama suspendendo a exploração de petróleo no Golfo durou apenas quatro meses e meio e ficou conhecida nos meios petrolíferos não como moratorium, mas como permitorium. (Veja-se B. Reddall, “”Analysis: Oil firms hurt by Gulf spill welcome back drill rigs”: “Oilmen deride that period as the permitorium”” http://www.reuters.com/article/2012/04/10/us-usa-gulfofmexico-idUSBRE8390IG20120410.). Já em março de 2012 a indústria do petróleo estava de volta com perfurações em grandes profundidades no Golfo do México, com mais oito contratos de plataformas marítimas envolvendo a Ensco, a Seadrill e a Transocean.

Enfim, a própria política de Obama é contraditória, pois se, de um lado, seu Clean Power Plan supostamente declara “guerra ao carvão”, de outro o Bureau of Land Management (pertencente ao Department of Interior cuja função, entre outras, é a execução das políticas energéticas) reabriu em 2014 suas concessões (leasing) para a exploração de carvão em terras pertencentes ao Estado, como mostra um documento do Greenpeace:

“o Bureau of Land Management (BLM) realizou durante a administração Obama concessões para a exploração de 2,2 bilhões de toneladas de carvão pertencentes ao Estado, liberando assim 3,9 bilhões de toneladas de poluição por esse combustível. Isso equivale às emissões anuais de mais de 825 milhões de veículos de passageiros e é mais que os 3,7 bilhões de toneladas emitidas por toda a União Europeia em 2012. (…) O programa federal de concessões redunda num subsídio maior para os combustíveis fósseis, favorecendo o carvão em detrimento de métodos mais limpos de geração de eletricidade. (…) O programa federal de concessões é a fonte de 40% de toda a extração de carvão nos EUA, com impactos maiores nos mercados de carvão e na poluição por carvão. Um departamento do BLM, em Wyoming, recentemente propôs um plano de novas concessões para a exploração de carvão que montam a 10,2 bilhões de toneladas, o que liberaria 16,9 bilhões de toneladas de poluição por carvão”.

(Veja-se: Leasing Coal, “Fuelling Climate Change. How the Federal Coal Leasing Program undermines President Obama’s Climate Plan”. Greenpeace, 23/IV/2014 <http://www.greenpeace.org/usa/research/leasing-coal-fueling-climate-change/>)

O ótimo trabalho de Asaf Shalev, Michael Phillis, Elah Feder e Susanne Rust, que Crisálida repercute abaixo, reforça a percepção de que a administração Obama foi, objetivamente, business as usual para a matriz energética fóssil.

Luiz Marques

Exclusive: an agency inside the Obama administration poured billions into fossil fuel projects that will lead to global carbon emissions on a damaging scale

President Barack Obama has staked his legacy on the environment, positioning his administration as the most progressive on climate change in US history.

However, an obscure agency within his own administration has quietly spoiled his record by helping fund a steady outpouring of new overseas fossil fuel emissions – effectively erasing gains expected from his headline clean power plan or fuel efficiency standards.

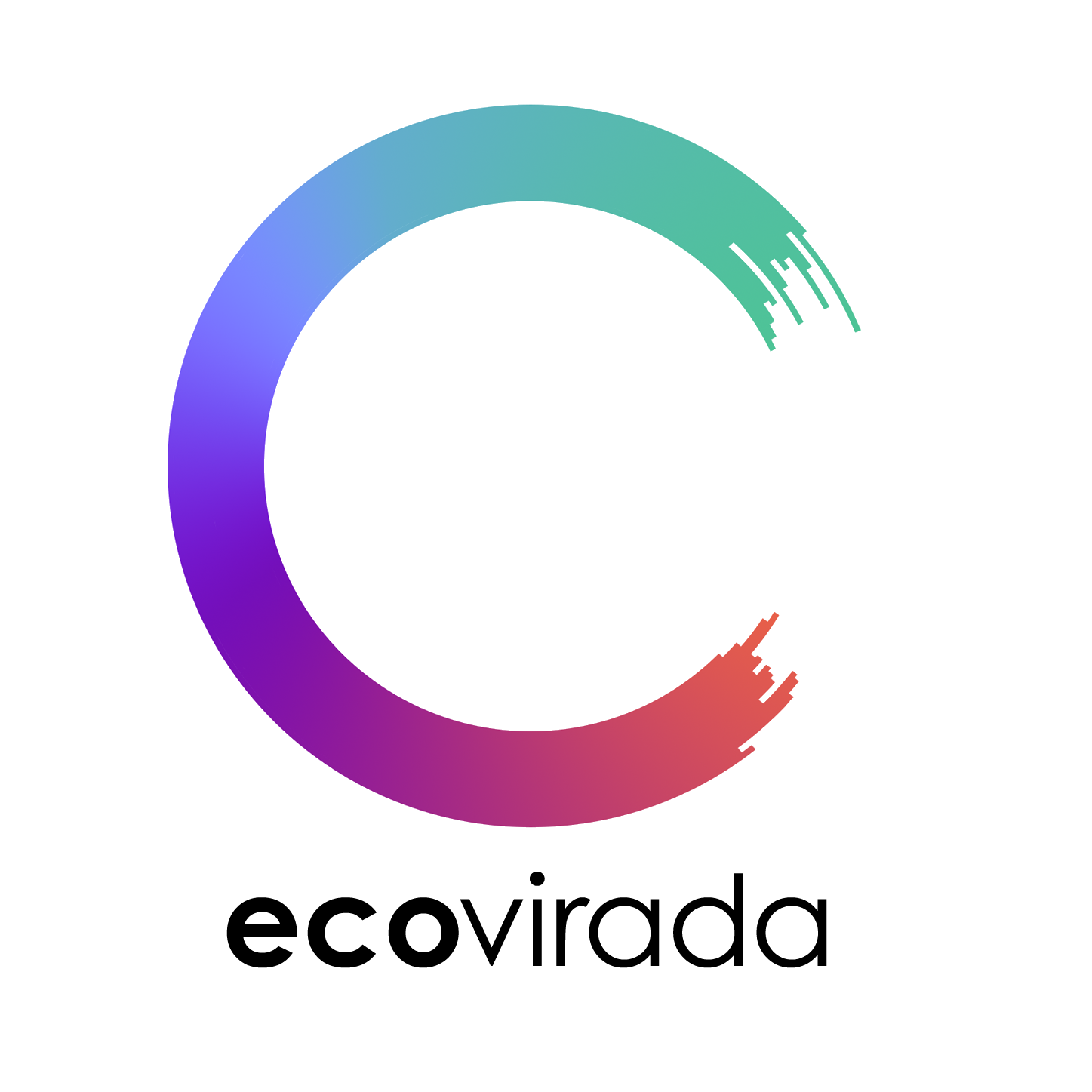

Since January 2009, the US Export-Import Bank has signed almost $34bn worth of low-interest loans and guarantees to companies and foreign governments to build, expand and promote fossil fuel projects abroad.

That’s about three times more financing than the taxpayer-backed bank provided during George W Bush’s two terms, and almost twice the amount financed with loans and guarantees under the administrations of Ronald Reagan, George HW Bush and Bill Clinton – combined.

The bank, which operates within Obama’s administration, provides US exporters with financing to sell goods and services overseas. Bank officials say it supports US jobs and fills a financing gap by allowing companies to access funding when private lenders will not.

Since 2009, it has financed 70 fossil fuel projects. When they are all completed and operating at full capacity, the bank estimates they will push 164m metric tons of carbon dioxide into the atmosphere every year – about the same output as the 95 currently operating coal-fired power plants in Ohio, Pennsylvania and Oklahoma.

That number does not include emissions from the numerous foundries, mines and smelters the bank also has financed around the world since 2009, nor does it include more than 600 transactions listed in the bank’s authorization database, in which the product or export is labeled as “N/A”, making it impossible to estimate the true size and extent of the bank’s carbon footprint.

The findings come after Guardian US and Columbia University’s Graduate School of Journalism’s Energy & Environmental Reporting Project spent almost six months viewing documents and data released under the Freedom of Information Act. The investigation team studied tens of thousands of bank transactions, interviewed dozens of sources, and examined scores of government, watchdog and academic reports showing how the 82-year-old bank has undercut the president’s environmental legacy.

Since 2014, the bank has made an effort to become more climate-conscious. Indeed, the vast majority of the bank’s fossil fuel financing took place before December 2013, when it adopted the president’s climate action plan and announced its intention to stop financing coal in all but the poorest countries.

But environmental critics say that in its zeal to increase exports after the 2008 financial crisis, the bank – which financed the construction of two liquid natural gas plants on an island in the Great Barrier Reef, two of the largest coalmines on the planet, and more than a dozen refineries and petrochemical plants in countries such as Saudi Arabia, India and Turkey – has put a permanent stain on the president’s environmental legacy.

“There is a tension between Obama’s strong efforts to reduce greenhouse gas emissions on the one hand and some of its lending activities abroad,” said Michael Gerrard, director of the Sabin Center for Climate Change Law at Columbia University.

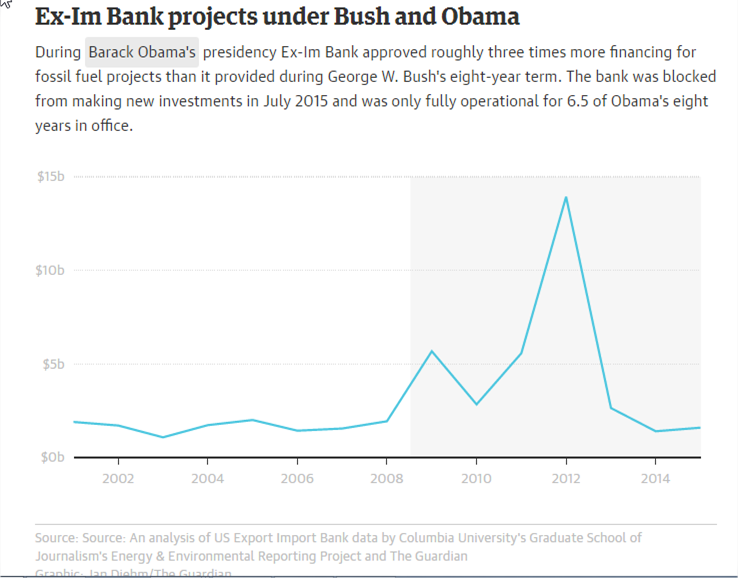

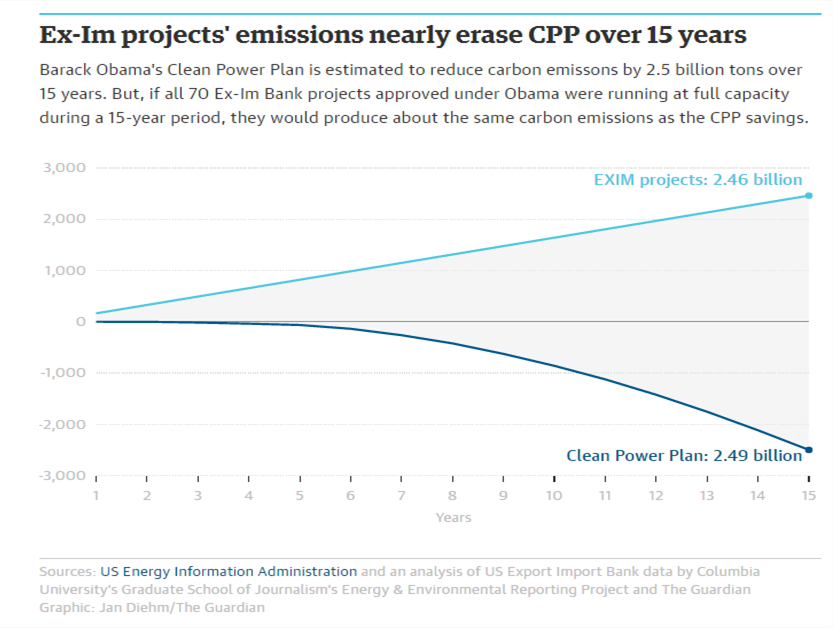

Our investigation shows the president’s domestic climate policies, including the 1.1bn ton carbon reduction promised with his new vehicle engine efficiency standards and the 2.5bn ton carbon savings the pending clean power plan is estimated to make, will largely be erased by the bank’s overseas emissions.

Barack Obama’s Clean Power Plan is estimated to reduce carbon emissons by 2.5 billion tons over 15 years. But, if all 70 Ex-Im Bank projects approved under Obama were running at full capacity during a 15-year period, they would produce about the same carbon emissions as the CPP savings

The bank – which a growing number of Republican members of Congress oppose, viewing it as a symbol of government largesse and corporate welfare – is almost universally supported by Democrats, who see it as a job maker and economic leveler for US exporters in the global market, who must compete against foreign companies financed by their own country’s export banks.

However, our findings show that not only does the bank violate Democrats’ environmental platform to reduce carbon emissions, but more than 28% of the bank’s long-term loan financing since 2009 has supported foreign-owned exporters that directly compete with US companies – including nearly $540m to Caterpillar’s biggest foreign competitor, the Japanese-owned Komatsu, to build a copper mine in Mongolia.

“At a time when we need to boldly transform our energy system away from fossil fuels and into energy efficiency and sustainable energies, the last thing we should be doing is providing corporate welfare to some of the biggest polluters on the planet,” said Senator Bernie Sanders, who opposes the bank.

How it works

The Export-Import Bank was established in 1934 by executive order from Franklin D Roosevelt to support the exchange of goods to and from the United States. Today, it provides insurance, working capital, loan guarantees and low-interest loans to US exporters, as well as overseas corporations using American-made goods.

The bank is self-sustaining and returns any surplus to the treasury, which was about $280m in 2016.

Since 1 January 2009 the bank has authorized more than 25,000 transactions worth more than $170bn total. Nearly 80% are insurance deals in which the bank insures a US exporter against nonpayment from a foreign country or company. In some cases, it is difficult to determine for whom or for what purpose the insurance policy was made.

However, the majority of authorizations – 68% or $116bn – are in the form of taxpayer-backed loans and guarantees, which generally go to foreign borrowers to use the services of American exporters.

For instance, in 2012, the bank loaned nearly $5bn to Dow Chemical and the Saudi Arabian state-owned oil and gas company, Saudi Aramco, to employ the Swiss engineering firm, ABB and “additional exporters” to build a power boiler and heat exchanger for a new petrochemical plant in Saudi Arabia. ABB manufacturing plants in Pennsylvania and Oklahoma engineered the parts. Other multibillion-dollar financing included $3bn in loans to a consortium led by ExxonMobil to build a liquid natural gas plant in the Papua New Guinea highlands, and $2.8bn in loans for the construction of a refinery in Colombia.

Ex-Im’s largest fossil fuel investments across the globe

The highlighted projects will be profiled in the next part of this series.

| Project name Description |

Country | Year Approved |

Emissions MMtCO2-e* |

Amount Millions |

| Sadara Petrochemical project Power boiler & heat exchanger manufacturing |

Saudi Arabia | 2012 | 4.24 | $4,975 |

| Papua New Guinea LNG Facilities support management services |

Papua New Guinea | 2009 | 3.1 | $3,000 |

| Australia Pacific LNG Engineering services |

Australia | 2012 | 5.6 | $2,866 |

| Refineria De Cartagena S.A oil refinery upgrade Engineering services |

Colombia | 2011 | 1.4 | $2,844 |

| Jamnagar Petrochemical plant expansion General industrial machinery & equipment |

India | 2012 | 9.75 | $2,100 |

| Queensland Curtis LNG project Engineering services |

United Kingdom | 2012 | 5.7 | $1,809 |

| Pemex exploration & production project Oil & gas field services |

Mexico | 2013 | 2.7 | $1,300 |

| Pemex oil & gas development Construction, mining, & forestry machinery |

Mexico | 2015 | 3.22 | $1,300 |

| Kusile 4,800MW coal-fired power plant Engineering services |

South Africa | 2011 | 29.9 | $806 |

| Pemex Oil & Gas exploration & production Turbine & turbine generator set units |

Mexico | 2014 | 2.7 | $800 |

| Reliance Sasan coal mine & 3,960MW power plant Construction Machinery & Equipment |

India | 2010 | 26.4 | $650 |

Source: An analysis of US Export Import Bank data by Columbia University’s Graduate School of Journalism’s Energy & Environmental Reporting Project and The Guardian

Greenhouse gas investments

Since Obama became president in 2009, overall financing by the bank has nearly doubled, going from about $13bn a year under President George W Bush, to an average of $25bn during Obama’s eight years. Yet, according to our investigation, investments in overseas fossil fuel projects have tripled under Obama.

“When President Obama got elected we had great hopes,” said Douglas Norlen, director of economic policy for Friends of the Earth US. “And then we watched Ex-Im’s fossil fuel financing skyrocket. We thought the situation was going to improve under Obama. We had no idea it was going to be far worse.”

Included in these transactions are two of the largest coal-fired power plants on the planet: Eskom’s Kusile power plant in South Africa and Reliance Energy’s Sasan plant, with combined yearly carbon emissions of more than 56m tons.

To put that into perspective, the average US coal-fired power plant produces 3.5m tons of carbon dioxide every year, with the largest, the James H Miller Jr plant in Alabama, producing 19m tons a year, according to the Environmental Protection Agency.

Bank officials say both overall and fossil fuel-related funding increased in the Obama years as a result of the economic downturn and a concurrent boom in commodities, which “precipitated an interest in large projects, including mining, power and petrochemical facilities”, said Caroline Scullin, the bank’s senior vice-president of communications.

During the president’s 2010 State of the Union address, he pledged to double exports over the following five years. In response, the bank, which supports about 2% of the country’s exports, identified fossil fuel and extractive industries as areas for growth.

Financing jumped from $2.9bn in 2009, when Obama took office, to a peak of $10bn in 2013.

Between 2009 and 2015, transactions included 28 loans and guarantees worth $8.5bn to the Mexican state-owned oil company, Petróleos Mexicanos, for exploration and drilling, as well as $1.5bn for gold, iron ore and copper mining in Mongolia, Ukraine and the Dominican Republic.

The bank was blocked from making new investments in July 2015, when Congress let its charter expire. And although the House and Senate voted overwhelmingly to reauthorize the bank five months later, it was down to two board members – and unable to approve transactions larger than $10m.

Senator Richard Shelby, a Republican from Alabama and chairman of the Senate committee on banking, housing and urban affairs, has refused to hold hearings for new board appointees, saying he “will continue to fight against any congressional action that would allow the bank to resume its role as an engine of corporate welfare”.

Congress is now looking for ways to circumvent Shelby’s blockade, a move that may happen before 9 December.

According to the bank’s website, potential projects include more dirty fuel investments – a coal-fired plant in Vietnam, a petroleum refinery in Kazakhstan and power plants in Pakistan, Egypt and Saudi Arabia.

Obama’s green legacy undermined

Obama’s efforts to reduce carbon emissions in the US are indisputable and include new fuel economy standards for cars and trucks estimated to reduce carbon emissions by 1.1bn tons – and his signature clean power plan, which, if enacted, will reduce the nation’s carbon dioxide output to 32% below 2005 levels.

His administration has also shown international leadership and invested in global efforts, including $3bn toward the Green Climate Fund, a coalition designed to help developing nations invest in low-emission energy sources and climate-resilient development.

It is unclear how these efforts will fare under Donald Trump’s presidency. He has called climate change a hoax and has promised to “cancel” the Paris climate deal, which aims to hold the planet’s temperature from rising more than 2 degrees Celsius above pre-industrial levels.

Despite Obama’s efforts, our investigation shows the Ex-Im Bank’s $34bn financing of overseas fossil fuel coal plants, refineries and pipelines undermines the carbon savings made by his fuel efficiency standards and clean power plan.

Using information from the Energy Information Administration, if the clean power plan were enacted this year, over the next 15 years it would reduce US carbon emissions by about 2.5bn tons. That is nearly the same number that the Ex-Im Bank’s overseas fossil fuel projects will produce over 15 years, assuming they were all running at full capacity.

While emissions supported by the bank aren’t counted toward US totals, their impact on climate change is identical whether they flow from a smokestack in Kentucky or South Africa.

“One unfortunate aspect of the current international climate change regime is that only a country’s own emissions within its borders count in its emissions inventories,” said Gerrard, the Columbia University law professor. “Those emissions go on the inventories of the countries where the pollution occurs, even though they have global impacts.”

Both the bank and the White House took issue with our findings.

John Morton, the National Security Council’s senior director for climate and energy, said:“Comparing projected emissions of Ex-Im-supported projects internationally to the emissions avoided by the clean power plan is at best an apples to oranges comparison, and at worst deliberately misleading. The clean power plan is projected to reduce emissions in the United States off of a specific business-as-usual baseline. This analysis includes no equivalent baseline, and therefore disregards the fact that without Ex-Im support, the vast majority of these projects would have been built with less efficient and higher polluting technologies, meaning more pollution than without Ex-Im action.”

He said 90% of the projected emissions came from projects financed in the early years of the Obama administration, before the president’s climate action plan was announced in 2013, adding: “The real story here is in the leadership that the president and the Ex-Im Bank have shown in adopting a policy to restrict financing for new coal-fired power plants overseas.”

Scullin, the bank’s spokeswoman, said our analysis overstated the bank’s emissions because the numbers the bank reports represent the total estimated carbon contribution from a project, not just the parts it financed.For instance, because the bank financed just the furnaces and ovens in the Star oil refinery in Turkey, she argued that it should not be accountable for all 2m metric tons of greenhouse gases emitted every year by the refinery.

Norlen, of Friends of the Earth, said Morton and Scullin’s arguments were weak, disingenuous and minimized the bank’s impact.

“The bank’s presence makes these projects more palatable to other financial institutions,” he said, providing the financial security and foundation for other credit agencies and banks to come on board.

Bank officials also said that despite their funding of fossil fuel projects, they are on the forefront of advancing green and climate-friendly policies.

In 1999, the US Export-Import Bank was the first export credit agency to track carbon emissions from its financed projects, and in 2013, acting on Obama’s climate action plan, bank officials announced they would stop investing in coal plants except in the poorest countries, including Bangladesh, Mozambique and Rwanda, or in middle-income income countries, such as Papua New Guinea and Vietnam. The investments would also be contingent on emissions being captured.

Officials note that one-third of the bank’s emissions are attributable to the two mega-coal plants financed before adopting Obama’s climate plan, and since then, projected emissions have fallen.

However, according to the bank’s website, a new coal plant in Vietnam is being considered for financing, along with a natural gas plant in Mozambique estimated to emit more than 5m tons of greenhouse gases every year and a petrochemical complex in Egypt that is projected to annually emit 3m tons.

Bank officials note they have also increased financing of renewable and clean energy projects under Obama’s tenure – 17 times more than during the Bush years. According to the bank’s data and annual reports, the board financed nearly $2bn in clean energy projects since 2009, including about three dozen wind projects in countries such as Mexico, Peru and Honduras and nearly 30 solar energy projects in India and South Korea.

The bank “is committed to advancing global efforts toward renewable and sustainable energy and power”, said Scullin, the bank’s spokeswoman. “We also recognize – as do the other 200 signatories of the landmark Paris climate agreement – that countries have different and sometimes pressing needs for power and energy investments.”

An uncertain future

In recent years, the bank has met growing resistance from members of the House and Senate who see it as an instrument of corporate welfare, providing billions of low-interest, taxpayer-backed loans and guarantees to major corporations such as Boeing, General Electric and Caterpillar.

Since 2009, seven of the bank’s 10 largest deals went to oil and gas giants, including ExxonMobil, BG Energy Holdings – which is now part of Royal Dutch Shell – and Australia Pacific LNG. Among these was a $1.3bn loan to Petróleos Mexicanos, which contracted with the misleadingly named exporter, Solar Turbines – a San Diego-based gas turbine manufacture – for oil and gas field services.

In addition, a review of the bank’s loans suggests that nearly $9bn – almost 28% of all loans – went to foreign-owned exporters, many of which are direct competitors of US-based companies.

For instance, the bank provided nearly $540m for Turquoise Hill Resources, a Canadian mining company, to buy equipment from Japanese-headquartered Komatsu America, a direct competitor of Caterpillar. And between 2012 and 2015, the bank provided companies in Saudi Arabia and Peru more than $600m to buy steam, gas and wind turbines from German-headquartered Siemens Energy. Siemens is a direct competitor of General Electric.

In both cases, manufacturing took place in the United States.

The bank’s focus is “jobs supported in the US regardless of the ownership of the corporate parent”, Scullin said. “When Siemens or any other foreign company manufactures in the US and provides jobs to American workers, we will finance the export of the American-made products. When they manufacture in Germany, we won’t finance.”

Bank officials say they have supported 1.4m jobs since 2009. However, phone calls to about 80 US exporters affiliated with more than 20 large fossil fuel projects revealed few keep statistics tracking jobs tied to bank financing. Of the nine companies that responded to requests for jobs numbers, only four companies reported that jobs were created or supported because of the bank. One said no jobs were created, three said there was no way to estimate, and one declined to offer any speculation.

Scullin says the bank uses a methodology approved by the Government Accountability Office to estimate jobs numbers, which includes not just jobs created directly by the financing, but downstream, indirect ones as well.

The bank’s future is unclear. While it enjoys majority support from Congress, a growing number are questioning its mission. And Trump has called it “featherbedding” for select politicians and companies.

Whether it lasts beyond 2019, when Congress debates reauthorization again, is uncertain. What is certain is that the greenhouse gases it financed with US taxpayer support will be with us for centuries.

Coming tomorrow: the impact around the world

Sonali Prasad, Hannah Furfaro, Eduardo Garcia and Gilda Di Carli contributed to this report

The Energy and Environmental Reporting Project is supported by the Blanchette Hooker Rockefeller Fund, Energy Foundation, Open Society Foundations, Rockefeller Brothers Fund, Rockefeller Family Fund, Lorana Sullivan Foundation and the Tellus Mater Foundation. The funders have no involvement in or influence over the articles produced by project fellows in collaboration with Guardian US

Você precisa fazer login para comentar.